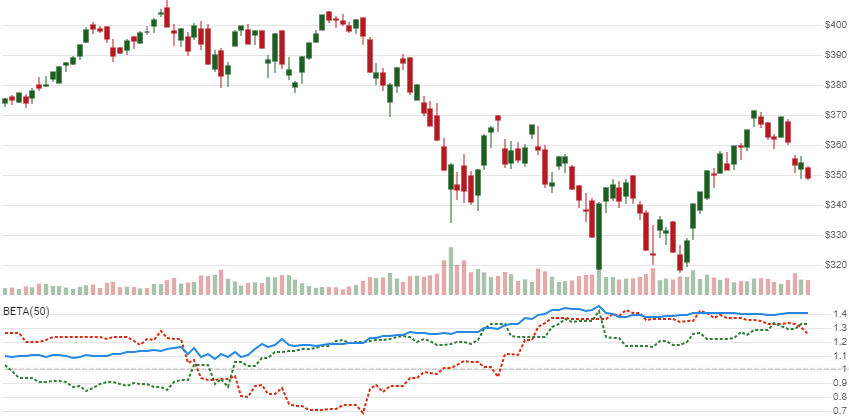

Beta Coefficient

Beta shows how strongly one asset’s price responds to systemic volatility of the entire market. Upside Beta (Beta+) and Downside Beta (Beta-), popularized by Harry M. Markowitz, are also included. [Discuss] 💬

// C# usage syntax

IEnumerable<BetaResult> results = quotesEval

.GetBeta(quotesMarket, lookbackPeriods, type);

Parameters

quotesMarket IEnumerable<TQuote> - Historical quotes market data should be at any consistent frequency (day, hour, minute, etc). This market quotes will be used to establish the baseline.

lookbackPeriods int - Number of periods (N) in the lookback window. Must be greater than 0 to calculate; however we suggest a larger period for statistically appropriate sample size and especially when using Beta +/-.

type BetaType - Type of Beta to calculate. Default is BetaType.Standard. See BetaType options below.

Historical quotes requirements

You must have at least N periods of quotesEval to cover the warmup periods. You must have at least the same matching date elements of quotesMarket. An InvalidQuotesException will be thrown if not matched. Historical price quotes should have a consistent frequency (day, hour, minute, etc). See the Guide for more information.

BetaType options

Standard - Standard Beta only. Uses all historical quotes.

Up - Upside Beta only. Uses historical quotes from market up bars only.

Down - Downside Beta only. Uses historical quotes from market down bars only.

All - Returns all of the above. Use this option if you want Ratio and Convexity values returned. Note: 3× slower to calculate.

💡 Pro tip

Financial institutions often depict a single number for Beta on their sites. To get that same long-term Beta value, use 5 years of monthly bars for

quotesand a value of 60 forlookbackPeriods. If you only have smaller bars, use the Aggregate() utility to convert it.Alpha is calculated as

R – Rf – Beta (Rm - Rf), whereRfis the risk-free rate.

Response

IEnumerable<BetaResult>

- This method returns a time series of all available indicator values for the

quotesprovided. - It always returns the same number of elements as there are in the historical quotes.

- It does not return a single incremental indicator value.

- The first

N-1periods will havenullvalues since there’s not enough data to calculate.

BetaResult

Date DateTime - Date from evaluated TQuote

Beta double - Beta coefficient based

BetaUp double - Beta+ (Up Beta)

BetaDown double - Beta- (Down Beta)

Ratio double - Beta ratio is BetaUp/BetaDown

Convexity double - Beta convexity is (BetaUp-BetaDown)2

ReturnsEval double - Returns of evaluated quotes (R)

ReturnsMrkt double - Returns of market quotes (Rm)

Utilities

See Utilities and helpers for more information.

Chaining

This indicator may be generated from any chain-enabled indicator or method.

// example

var results = quotesEval

.Use(CandlePart.HL2)

.GetBeta(quotesMarket.Use(CandlePart.HL2), ..);

🚩 Warning! Both eval and market arguments must contain the same number of elements and be the results of a chainable indicator or

.Use()method.

Results can be further processed on Beta with additional chain-enabled indicators.

// example

var results = quotesEval

.GetBeta(quotesMarket, ..)

.GetSlope(..);