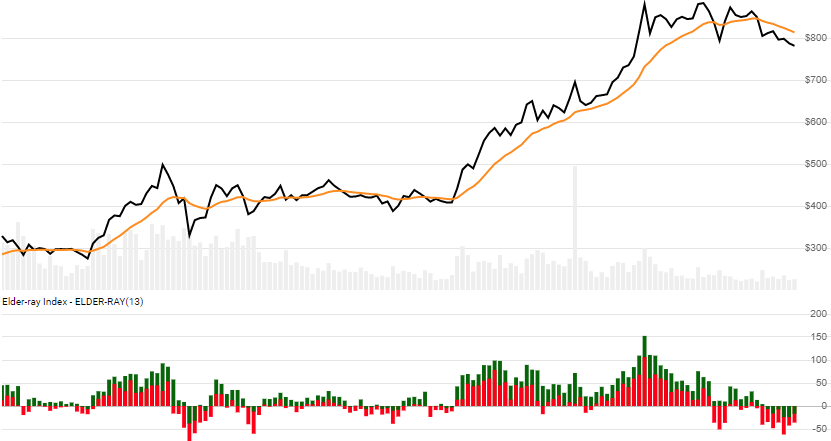

Elder-ray Index

Created by Alexander Elder, the Elder-ray Index, also known as Bull and Bear Power, is an oscillator that depicts buying and selling pressure. It compares current high/low prices against an Exponential Moving Average. [Discuss] 💬

// C# usage syntax

IEnumerable<ElderRayResult> results =

quotes.GetElderRay(lookbackPeriods);

Parameters

lookbackPeriods int - Number of periods (N) for the underlying EMA evaluation. Must be greater than 0. Default is 13.

Historical quotes requirements

You must have at least 2×N or N+100 periods of quotes, whichever is more, to cover the warmup and convergence periods. Since this uses a smoothing technique, we recommend you use at least N+250 data points prior to the intended usage date for better precision.

quotes is a collection of generic TQuote historical price quotes. It should have a consistent frequency (day, hour, minute, etc). See the Guide for more information.

Response

IEnumerable<ElderRayResult>

- This method returns a time series of all available indicator values for the

quotesprovided. - It always returns the same number of elements as there are in the historical quotes.

- It does not return a single incremental indicator value.

- The first

N-1periods will havenullindicator values since there’s not enough data to calculate.

⚞ Convergence warning: The first

N+100periods will have decreasing magnitude, convergence-related precision errors that can be as high as ~5% deviation in indicator values for earlier periods.

ElderRayResult

Date DateTime - Date from evaluated TQuote

Ema double - Exponential moving average

BullPower double - Bull Power

BearPower double - Bear Power

Utilities

See Utilities and helpers for more information.

Chaining

Results can be further processed on (BullPower+BearPower) with additional chain-enabled indicators.

// example

var results = quotes

.GetElderRay(..)

.GetEma(..);

This indicator must be generated from quotes and cannot be generated from results of another chain-enabled indicator or method.