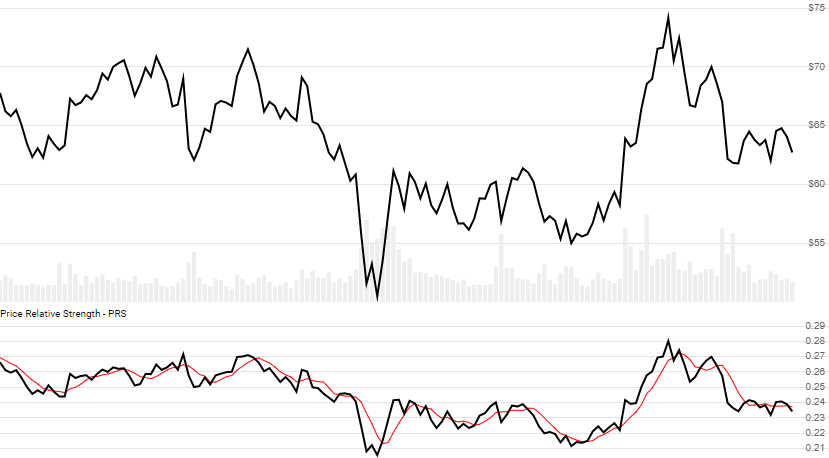

Price Relative Strength (PRS)

Price Relative Strength (PRS), also called Comparative Relative Strength, shows the ratio of two quote histories, based on price. It is often used to compare against a market index or sector ETF. When using the optional lookbackPeriods, this also returns relative percent change over the specified periods. This is not the same as the more prevalent Relative Strength Index (RSI). [Discuss] 💬

// C# usage syntax

IEnumerable<PrsResult> results =

quotesEval.GetPrs(quotesBase);

// usage with optional lookback period and SMA of PRS (shown above)

IEnumerable<PrsResult> results =

quotesEval.GetPrs(quotesBase, lookbackPeriods, smaPeriods);

Parameters

quotesBase IEnumerable<TQuote> - Historical quotes used as the basis for comparison. This is usually market index data. You must have the same number of periods as quotesEval.

lookbackPeriods int - Optional. Number of periods (N) to lookback to compute % difference. Must be greater than 0 if specified or null.

smaPeriods int - Optional. Number of periods (S) in the SMA lookback period for Prs. Must be greater than 0.

Historical quotes requirements

You must have at least N periods of quotesEval to calculate PrsPercent if lookbackPeriods is specified; otherwise, you must specify at least S+1 periods. More than the minimum is typically specified. For this indicator, the elements must match (e.g. the nth elements must be the same date). An Exception will be thrown for mismatch dates. Historical price quotes should have a consistent frequency (day, hour, minute, etc).

quotesEval is an IEnumerable<TQuote> collection of historical price quotes. It should have a consistent frequency (day, hour, minute, etc). See the Guide for more information.

Response

IEnumerable<PrsResult>

- This method returns a time series of all available indicator values for the

quotesprovided. - It always returns the same number of elements as there are in the historical quotes.

- It does not return a single incremental indicator value.

- The

Nperiods will havenullvalues forPrsPercentand the firstS-1periods will havenullvalues forSmasince there’s not enough data to calculate.

PrResult

Date DateTime - Date from evaluated TQuote

Prs double - Price Relative Strength compares Eval to Base histories

PrsSma double - Moving Average (SMA) of PRS over S periods

PrsPercent double - Percent change difference between Eval and Base over N periods

Utilities

See Utilities and helpers for more information.

Chaining

This indicator may be generated from any chain-enabled indicator or method.

// example

var results = quotesEval

.Use(CandlePart.HL2)

.GetPrs(quotesBase, ..);

🚩 Warning! Both

quotesEvalandquotesBasearguments must contain the same number of elements and be the results of a chainable indicator or.Use()method.

Results can be further processed on Beta with additional chain-enabled indicators.

// example

var results = quotesEval

.GetPrs(quotesBase, ..)

.GetSlope(..);